The Transitional Reinsurance Program – Reinsurance Contributions (RIC)

Who Makes Contributions in 2015?

Contributing entities are required to make contributions to fund the reinsurance program.

Contributing entities include:

- Health insurance issuers

- Self-insured group health plans

- Group health plans with a self-insured coverage option and an insured coverage option

- Multiple group health plans, including an insured plan, that are maintained by the same plan sponsor, that collectively provide major medical coverage for the same covered lives simultaneously

- Multiple group health plans, not including an insured plan, that are maintained by the same plan sponsor, that collectively provide major medical coverage for the same covered lives simultaneously

Although a contributing entity is responsible for the reinsurance contribution, it may use a TPA or ASO contractor to support the reinsurance contribution process.

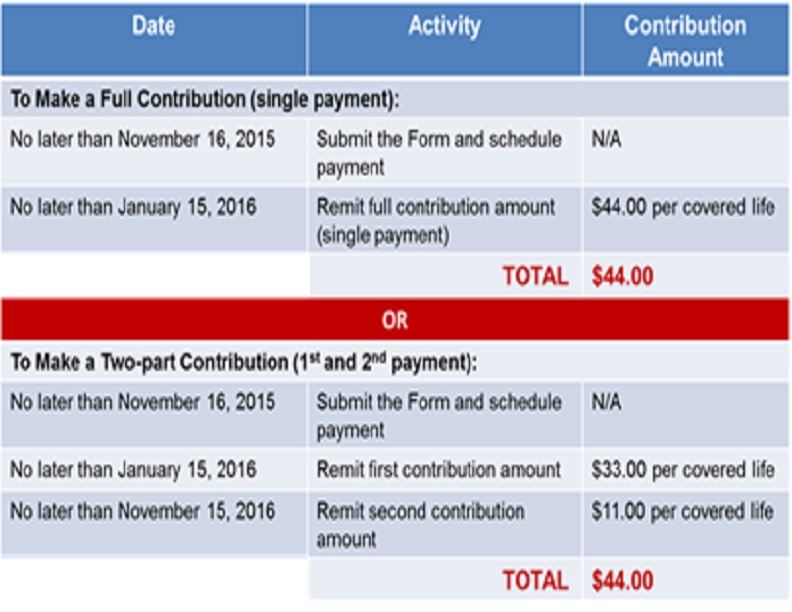

Payment Options

The 2015 Reinsurance Contribution Rate is $44.00 per covered life.

Contributions can be made:

- In one lump sum of $44 per covered life

- In a two-part payment of $33 per covered life (first payment, due immediately) and $11 per covered life (second payment, due by November 15, 2016)

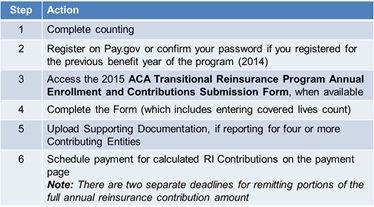

2015 Web-Based Training

For more information on completing the 2015 Form or the 2015 Supporting Documentation, use the 2015 Reinsurance Contributions Form Completion and Submission Web-Based Training (WBT). This WBT is readily available to walk users through the process to create the 2015 Supporting Documentation and complete the 2015 Form. This Web-Based Training is available at: https://www.regtap.info/ricontributions.php.

Educational Resources

- 2015 Reinsurance Contributions Tools and Resources (PDF)

- Web-based Training on 2015 Reinsurance Contributions Form Completion and Submission

- 2015 Reinsurance Contributions Glossary (PDF)

- 2015 Supporting Documentation Job Aid and Job Aid Manual (ZIP)

- 2015 Supporting Documentation File Layout Requirements (PDF)

- Quick Start Guide to the 2015 Transitional Reinsurance Form (PDF)

- 2015 Reinsurance Contributions Annual Enrollment and Contributions Submission Form Manual (PDF)

- 2015 ACA Transitional Reinsurance Program Updating Contributions Filing Manual (PDF)

2015 Presentations for the Reinsurance Contributions Submission Process

- Module 1 – Transitional Reinsurance Program Overview for the 2015 Benefit Year (PDF)

- Module 2 – 2015 Reinsurance Contributions Counting Methods Overview (PDF)

- Module 3 – 2015 Reinsurance Contributions Program Form Completion, Submission and Payment (PDF)

- SPECIAL TOPIC: Successful Completion of the 2015 Reinsurance Contributions Supporting Documentation (PDF) (.CSV file, Applicable when Reporting Four or More Contributing Entities)

- Module 4 – 2015 Reinsurance Contributions Updating Contributions Filings (PDF)

2015 Operational Guidance Documents

- The Transitional Reinsurance Program Operational Guidance: Examples of Counting Methods for Contributing Entities (PDF) – UPDATED FOR THE 2015 BENEFIT YEAR

- Transitional Reinsurance Program – Timing of Contributions Refund Requests Due to Annual Enrollment Count Misreporting (PDF)